What is required for Brands to serve customers in social distancing era- Part 1?

- Anupam Ahluwalia

Covid19 has reset the world in a way that we could never imagine. In a world of uncertainty where everyone is grappling for answers, only one thing is known- we will all find ourselves in a changed world and perhaps, somethings would have changed for good. One of them is possibly changing consumer preference for online modes of shopping that enable them to practice social distancing as much as possible

So, what does it mean for Brands in building & home maintenance products who sell primarily via offline retailers?

While no one can offer definite answers, there are some patterns which can guide our thinking. I have summarized my thoughts, focusing on what Brands, who sell via offline retailers, can do to support their customers in this era of Social distancing.

I have analyzed this via the following:

- What kind of demand would we see returning first up – Purchase context

- Who will be majorly making buy decisions- buy decision influencers by purchase context

- Problem context- traditional offline methods

- What does going online mean- breakdown of purchase related customer interactions

Likely Purchase Context in immediate future

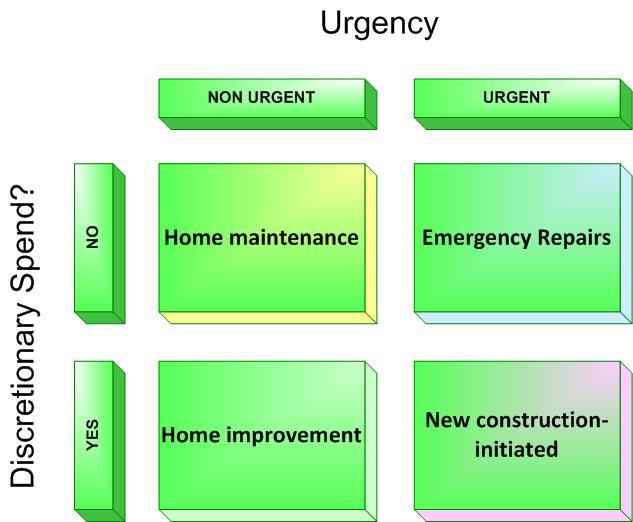

Following are the broad categories of purchase context for Building materials and home maintenance products:

- Home maintenance & minor non-urgent repairs- Non-discretionary and not urgent. For example, replacement of a switch, broken glass, fix a furniture etc.

- Home improvement & redecoration- Discretionary and not urgent. For example, repaint the house, redesign interiors etc.

- Major repairs and emergency ‘fixes’- Non-discretionary and urgent. For example, fix water leakage, short circuits, replace flooring, windows etc.

- New & under construction- Discretionary and urgent when in progress. For example, add a new floor, outhouse or new construction etc.

Below matrix summarizes the purchase context:

While it is true, as I said before, it’s probably not possible for anyone to make an accurate prediction on type and extent of demand that will be dominant in near future which itself depends on several variable factors, we can use above analysis to guide assessment.

It is possible that there is pent-up demand which has been building over months of lockdown. When customers feel able and ready, it’s quite likely that they will focus on primarily non-discretionary purchase, this means primarily home maintenance needs (as emergency repairs related purchase are anyways being done and are a smaller overall share of total purchases).

Buy decision influencers by Purchase context

For buy decision makers we define following categories:

- End Consumer- Consumer who actually pays for the purchase

- Worker- Electrician, painter, mason, raj mistri, carpenter, worker contractor etc.

- Professional- Architect, Interior designer and building contractors etc.

The table below provides the key influencers or role players who are involved in decision making by demand type

Roles are defined as follows:

- Major- Major role in purchase decision, decides what Brand/product to buy, from where etc

- Minor- Usually not involved actively but needs information or validates or influences

- Irrelevant- not involved

| Purchase Context | End Consumer | Worker | Professional |

| Home maintenance & minor non-urgent repairs | Major | Minor | Irrelevant |

| Home improvement & redecoration | Major | Minor | Major |

| Major repairs and emergency ‘fixes’ | Minor | Major | Irrelevant |

| New construction | Major | Minor | Major |

To conclude, it follows that in immediate future it is likely that End consumers are a major role player in purchase decisions for purchase context of Home maintenance products and Brands must recalibrate their strategies to ensure they are well positioned to fulfil end consumer driven demand.

The Problem context

If consumers are to be served, then it poses a question- will they continue to use the traditional, established modes of purchase via offline markets?

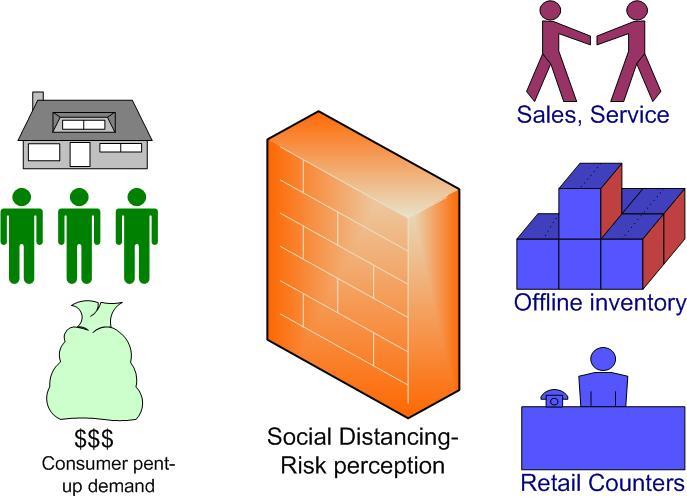

The patterns of consumer behavior from markets which have opened in other countries, indicate that customers aren’t quite flocking to markets, conscious of exposure risks and hence social distancing is likely to be a continuing concern. Other factor is broadly accepted view, that it takes 3-6 weeks for a habit to form, hence online mode might become the norm for a section of customers.

In India, where Brands have invested and built network of retailers, loyalty members that relies on customer visits for transactions, this poses a key issue for the offline inventory & distribution model.

It is, of course, not possible to visualize obliterating the entire distribution model and solutions must be found that work with the existing distribution chains while supporting customer preferences to practice social distancing. This requires offering online means for customers to replace their activities that previously required offline, physical visits. But how can this be done and what are the implications?

To effectively address this question, we must analyze all the consumer activities involved in purchase transactions.

Consumer purchase –breaking down activities

At the outset, I must clarify that there are differences across industries- some industries primarily operate via workers/professionals recommendations only or some only via authorized dealers. The objective here is to list out all activities with potential exposure, not all of these may apply to all industries.

Following is the list of consumer activities that involve some element of interaction:

Pre-Purchase Activities

- Product Search- look for specific products

- Solution Search- look for worker who can fix a problem- service & recommend product

- Advisor- Connect & seek advice before identifying a product/service need

- Derisk - product credentials- Check various competing products

- Derisk- price- check competing offers, price quotes before purchase

- Price -shop hopping- check same product prices from multiple points

- Validate dealer credentials- warranty availability

Purchase Activities

- Actual purchase- pick products or get it delivered

- Service provider checks- credentials & availability check

Post Purchase Activities

- Claim Benefits - claim any benefits available, register product etc for warranty

- Audit history- maintain invoices etc

- Support & feedback- provide feedback

Hence to effectively support end consumers, who wish to avoid exposure by visiting markets, it is not enough to offer a channel to purchase products, instead strategies that enable all or most of above without requiring customer to leave his home as far as possible will be required.

Analyses of above will make this blog too long, hence I will tackle this in Part -2.

Conclusion

The Covid-19 related consumer preferences suggest change to online modes. Immediate purchase context is likely to be pent-up non-discretionary home maintenance demand, hence solutions must be put in place in short term that support consumers desire to transact from safety of their homes. It is possible, that Brands who successfully do it, will stand to gain advantage. However, just online eCommerce purchase channels are not sufficient for Brands to offer complete online experience as breakdown of activities above suggests.

Note:Please note, this is not consistent across industries and variations do exist, however we have used common denominator across industries in building materials and home maintenance products with wide variation. This is highly subjective as role play is broadly different across industries,