Market Intelligence- The defining layer you might be missing

- Anupam Ahluwalia

In one of my previous blogs, I introduced cascading layers of characteristics a field automation solution must possess in unorganized retail based selling context-URC (e.g. via distribution network). I have detailed out specifics of each of the bottom 3 layers for Unorganized retail context in separate blogs. Now it is time to produce the final article of this series on last remaining layer- Market Intelligence!

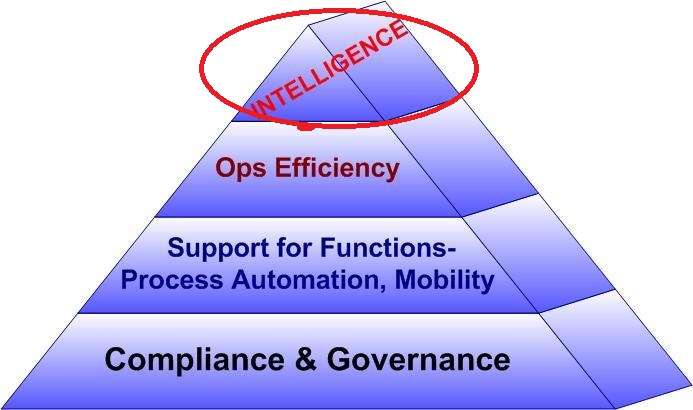

Before we move forward, for sake of continuity, let me reproduce the cascading layers as below:

Market Intelligence

I must confess that only article I wished to write was about Market Intelligence aspects because that is the key set of functionalities that majorly define the characteristics differences of SFA systems used in B2B context vs B2C (URS- Unorganized Retail Selling) context.

My fear, based on my interactions in market, was that the distinction will get lost as most confuse the umbrella term of Business Intelligence as sufficient capability to fulfil all requirements necessary for any SFA context. I will demonstrate in this article, that it is not true. You can only deliver Business Intelligence (via relevant reporting/alerting engines built in enterprise class SFAs) over data that your SFA enables your field force to collect. And therein lies the difference.

This is where features that are relevant to Unorganized Retail driven selling fundamentally differ from ‘normal’ SFA systems which are designed for B2B. Following are key capabilities that must be supported for systems seeking to serve this requirement context:

A key aspect of suitable system is that it allows for comprehensive competitor tracking, traditional SFAs typically focus on automating functions etc, with little focus on providing a competitor tracking view.

The focus on traditional SFA systems is on pipeline deals or campaigns, however key capability from intelligence perspective for unorganized retail context is micro market focus. I.e. decision makers seek to understand micro market metrics and consumer behavior in micro markets more than anything else.

Following from above, the unorganized retail selling system is focused on data points rather than data types more than anything else.

Often trends are important with lead time to act upon (for certain types of trends) quite short. For example, price adjustment opportunities might require a daily trend analysis, while promotion launch by competitor might demand immediate attention.

The data points are often scattered hence such system must provide a comprehensive suite of correlating reports for intelligence, for example, impact of promotion on price, impact on sales volumes based on price adjustment, price correlation with stock positions at micro & macro levels etc.

Given the dynamic nature of such businesses, it should be possible to continually increase the new events and data collection based on context, for example, take information on impact from a new disruptive product, add consumer surveys for a new category of consumers etc.

Note: Red in above denotes the lookout capabilities that are specific to URC in traditional sense.

Conclusion

I conclude here for the Market Intelligence capability as well as for the series of about 6 articles I have put together as part of sharing my understanding and views on Sales Force Automation system desired characteristics in Unorganized Retail Context (channel sales via third party small retailers).

There is a risk that brands selling via unorganized retail may miss out Intelligence aspect of capabilities required in their solution approach altogether since Business Intelligence via various charting capabilities delivers insights on their own functions, giving false sense of sufficiency. However, most SFAs are designed to automate sales & customer relation functions, hence usually not geared to deliver aspects like competitor activities & positions (like price differentials at micro market levels), consumer buying behavior differences across micro markets, promotion impact tracking by competitors such as upon price etc. Such insights have the potential to deliver cost savings (save of expensive third-party agency surveys & campaigns) as well as incremental advantage (react quickly to change in pricing conditions).

Concluding the series…

We have demonstrated in this series of articles, that one size fits all is not true. We have done so with analysis of differences in selling context and then using the analysis as base to break down characteristics in cascading capability layers. The cascading layers represent the ‘omnipresent’ in some form at bottom to more specific towards the top. Thereafter we have analyzed for each layer specific differences that follow from the nature of sales context in Unorganized Retail channel based sales.

A quick note to add: I felt it was necessary for this to come out in some written form which serves community of practitioners and academicians alike in any way they wish to use. My purpose stands served if it makes any difference at all to recognize and further develop management theory & practice around automating functions for Unorganized channel sales context.