Characteristics of SFA systems in Unorganized Retail Sales Context (URC)

- Anupam Ahluwalia

In my last blog I talked about how the Sales operations in an unorganized retail chain driven selling environment are fundamentally different to organized retail chain (e.g. Tesco/Walmart etc) based operations or B2B sales operations. This has several implications on choice of automation strategy for Sales operations for brands operating in this space. In this blog, I have tried to highlight a few.

Here I have used SFA – Sales Force Automation- as general term for class of software systems used for automating Sales Operations for any organization / brand with a field workforce. A number of mature offerings are available in market. Many of them have evolved from pure play CRM (Customer Relationship Management) and other specialized systems such as marketing campaign related tools etc.

However, how requirements differ for consumer centric Brands whose products are sold via third party distribution chains & offline retailers to end consumers vs B2B sales where customers are large organizations who make large value purchases, is somewhat a less explored area.

Part of the reason why differences in managing offline unorganized retail is less explored is because , in my opinion, in OECD countries bulk of the offline retailing is done via large retail chains such as Walmart, Tesco and other retail giants where agreement to stock/sell via retail chains has similar characteristics as a large institutional or B2B sale scenario. Since most of the major SFA vendors have evolved from serving these markets, the concept of SFA has largely been understood and aligned to automating sales functions for such scenarios. Although, it’s important to mention, many of these products may have added customizations for covering part of requirement context of unorganized retail sales.

To understand, how it should differ for unorganized retail, we need to analyze the differences in characteristics of Sales Operations of URC (Unorganized Retail Chains) vs organized retail or B2B selling. I have explored this in detail in my last blog, kindly refer to blog "B2B_vs_UnorganizedRetailChain_SalesOperations" for detailed analysis.

The summary is produced as below:

| Type of difference | B2B Sales Key attribute | Unorganized Retail Key attribute | |

| 1. | Sales Function | Customer problem solving per deal, teams often organized by domain expertise. | Operations effectiveness, micro market coverage, teams often organized by geography. |

| 2. | Sales Touchpoints | 'Navigate'- at various levels multiple stakeholders | 'Service'- individual small business owner |

| 3. | Deal size | Large, involved decision making for long term relationship | Irrelevant at micro level except logistics stand point |

| 4. | Sales Cycle | Long, complex, per deal manage resources and investment | Non existent, repeat orders from retailers driven by consumer demand |

| 5. | Target Customers | Enterprises, generate credibility for relationship | Small shop owners, incentivize, provide leads and support |

| 6. | Promotion and campaigns | Targeted small campaigns, lower budget designed to generate meeting opportunities. Perception has limited impact. | Large, frequent, different types- deliver feedback loop for market fit, track competitors, incentivize trusted advisors, influencers. Perception has game changing impact. |

| 7. | Operations Management | Qualify leads, manage deal dimensions and progressively more complex in Sales cycle | Manage geographic reach, compliance of work force, deliver operations cost savings while ensuring effectiveness. |

Analyzing above differences, I conclude following points are worth highlighting:

- Governance, compliance and monitoring is much more important in unorganized retail as volume, geographic spread and micro markets tend to be large.

- Market Intelligence is a crucial function intertwined with sales.

- Incentives, promotions such as Marketing schemes for retailers offering deals from time to time, Loyalty Plans incentivizing consumers for repeat purchase is much more important.

- Reducing process time even by a small fraction can have a substantial cumulative impact due to large number of field processes which are short.

- A structured mechanism to address field feedback, cases is needed because listening carefully to market is important.

- Regular surveying customers, rewarding customers, greetings etc. are important to retain customers and capture mind space, create brand recall at time of purchase.

- Operations management offers substantial opportunities for cost savings by addressing relatively small optimizations such as optimum route, pre-defined beat plans etc.

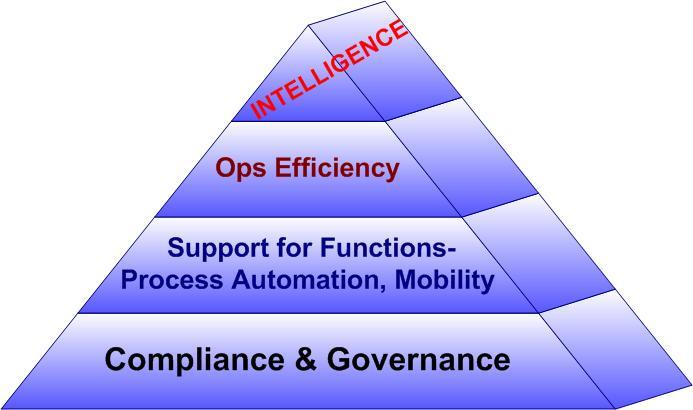

Based on above, I feel following pyramid best captures the solution characteristics for unorganized retail:

Above pyramid describes the cascading levels of capabilities SFA solution must possess for successful use in unorganized retail based selling context.

Each of these require detailed analysis and deserve a blog/article dedicated to these separately. However, for purposes of this article, what these mean are mentioned as follows:

At the most basic level, your SFA solution must enable complete governance, compliance and monitoring capabilities for managing your field operations.

This refers to mobile based process automation for field force, such as collecting orders, delivering customer service etc. Though It may well be the most important aspect, or dare I say, predominant aspect in B2B sales, however in URC scenario, this is one of the many aspects.

Ah, the cliché of cost efficiencies is here! Hold on though, Operations of unorganized retail are significantly more complex, a lot more processes are involved, so its but natural that Operations efficiency are at the core of it. The basic premise of such a system is to drive cost savings at the minimum. There are many areas where savings from operations efficiencies accrue from, which I will detail in my next blogs.

This is where features that are relevant to URC fundamentally differ from ‘normal- traditional’ SFA systems. Gathering intelligence is much more relevant in this requirement context than B2B context where focus may be on deal specific intelligence alone or campaign fulfilment functions.

Conclusion

There is a risk that brands selling via URC may miss out at minimum Intelligence aspect of capabilities required in their solution approach altogether. This is possible, even likely, because traditional SFA industry has evolved from B2B / institutional sales context. While many such systems will offer the bottom three layers as defined in the pyramid above to varying degree, brands must analyze the importance of Intelligence capabilities in their context before choosing a solution strategy.

In my next set of blogs, I will be breaking down each of the above layers in capability terms which will highlight the differences required in strategy even more clearly.